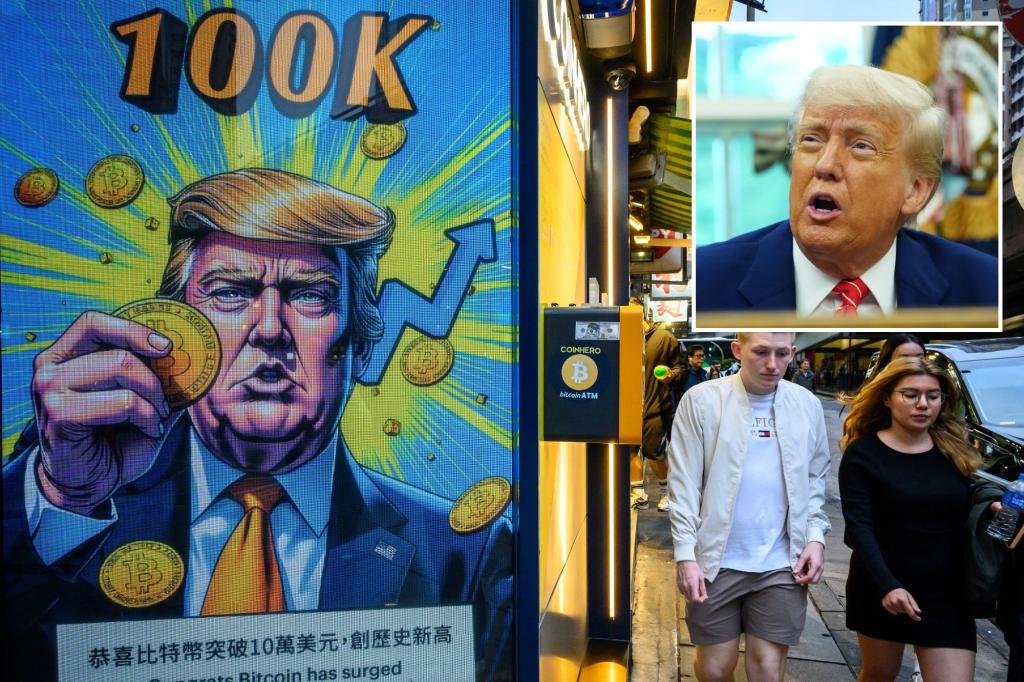

Bitcoin topped $100,000 on Thursday for the first time since early February, bolstered by a wide-ranging deal between the US and the United Kingdom in a sign that perhaps President Trump’s trade war with the rest of the world is easing.

By midday, bitcoin was trading at $101,329.97, a 4.7% gain on the day.

The world’s biggest cryptocurrency has clawed its way back into positive territory for the year, although it remains below the record high of more than $109,000 reached in January.

Ether, the cryptocurrency for the Ethereum blockchain, surged more than 14% to $2,050.46 after earlier hitting its highest since late March.

Trump and British Prime Minister Keir Starmer on Thursday announced a “breakthrough deal” on trade that leaves in place a 10% tariff on UK goods imported into the US, while Britain agreed to lower its tariffs to 1.8% from 5.1% and provide greater access to US goods.

The agreement is the first since Trump triggered a global trade war with a barrage of tariffs on trading partners following his return to the White House in January.

“The retaking of $100,000 must go down as one of bitcoin’s more formidable feats and is a reminder that buying peak fear — just last month bitcoin was languishing around $74,000 — can be exceptionally lucrative,” Antoni Trenchev, co-founder of digital asset trading platform Nexo, said in an emailed comment.

“The speed of the rebound to $100,000 amid a resumption of risk appetite sends a signal that $109,000 and above are in its sights, as buying from long-term holders — those holding for at least 155 days — more than offsets selling by short-term holders.”

Bitcoin and other crypto prices fell sharply between February and April, as traders fretted about Trump pushing through pro-crypto reforms more slowly than anticipated.

The president’s announcement of widespread tariffs in early April triggered a dash into safe havens, with bitcoin and other crypto prices tumbling in tandem with stocks and other higher risk assets.

Other cryptocurrencies have not recovered so strongly, with ether still 50% off its late 2024 highs.

Joel Kruger, market strategist at fintech company LMAX Group, said institutional investor inflows into bitcoin exchange-traded funds, easing geopolitical tensions and Chinese measures to boost monetary stimulus had contributed to bitcoin’s surge.